Why do Investment Funds and Portfolio Companies

struggle to align on mission-critical priorities?

1

Disagreements regarding cost cutting measures.

2

Disagreements over control of day-to-day management responsibilities.

3

Differences of opinion regarding run and grow the business.

Investors and portfolio companies have unique

challenges & priorities

Do you agree to the...

Investors

Key Pain Points

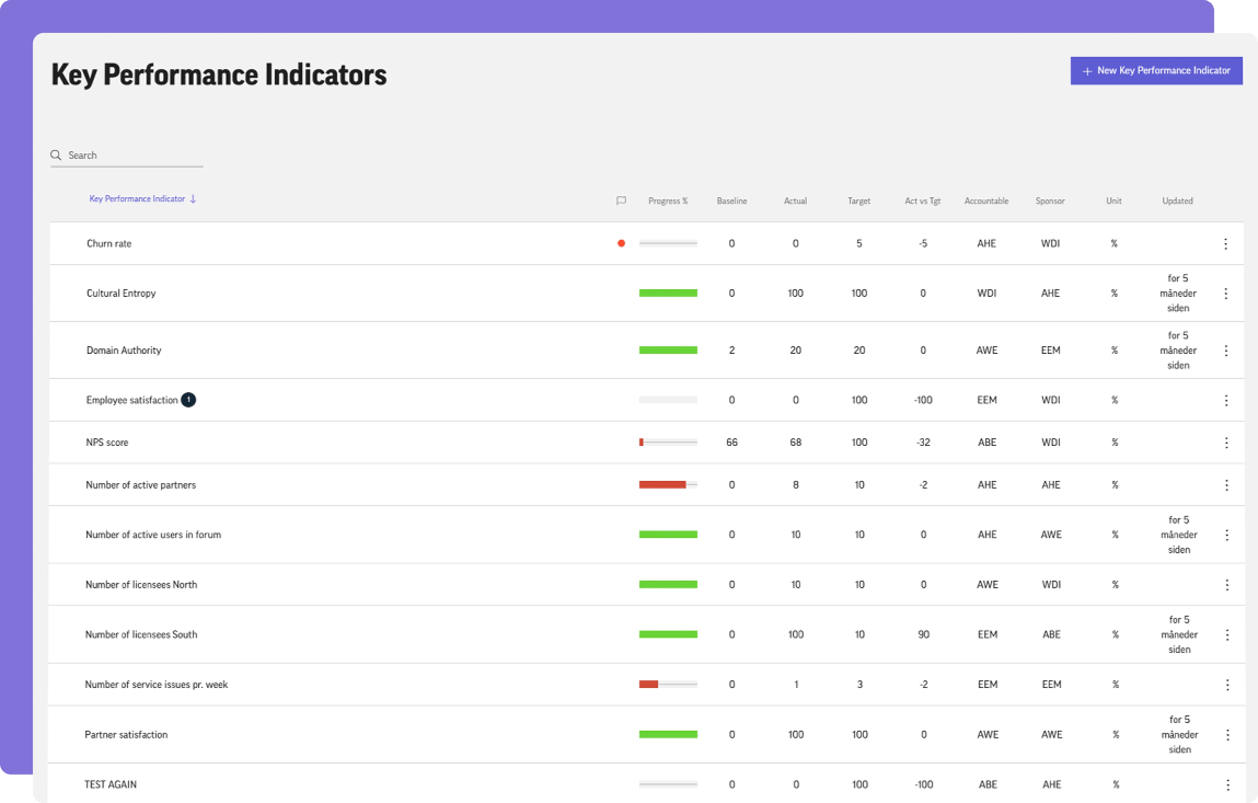

- Difficulty in improving execution skills and tracking within portfolio companies leading to sub-optimal results and/or inability to compare progress.

- No digital repository of best practices for strategy execution, cost optimization, and leadership practices.

- Lack of agility and quality in achieving results due to sub-optimal tracking processes.

Mission Critical Priorities

- Increased return on investment for the PE Fund shareholders/investors

- Assist portfolio company growth through operationalizing strategy, and day-to-day leadership excellence.

- Optimize cost in portfolio companies through tracking of cost optimization initiatives.

- Create synergies between portfolio companies to enhance the marketable value of the PE Fund.

- Create a PE Firm brand known for its network, innovation culture, leadership capabilities, and ease of doing business.

Do you share the...

Portfolio Companies

Key Pain Points

- Time and effort involved in changing existing practices and processes around strategy execution.

- Strategy documents can’t be converted into a quantifiable set of strategy initiatives.

- Optimize the run of the business.

Mission Critical Priorities

- Delivering profitable growth and return on investment & equity for shareholders.

- Capture and leverage best practices, innovation knowledge, governance, and leadership to increase customer value, employee experience, and shareholder impact.

- Create and execute a (new) growth strategy for the organization.

- Attracting and retaining top talent.

- Create a PE Firm brand known for its network, innovation culture, leadership capabilities, and ease of doing business.

3 out of 4 strategies fail in execution.

Imagine your risk when investing $10 million in a strategy that has 75% chance to fail?

How can DecideAct reduce your risk by optimizing

your investment for company growth?

Investors

Portfolio Companies

Different pain points and priorities but a solution that addresses both and creates full alignment

Companies

Drive value between Investors and Portfolio Companies

Value Creation

Assistance in developing company strategy.

Learn moreCost Optimization

Get most out of the money through cost optimizations strategies.

Learn moreAlignment

Aligning governance overview and participation in day-to-day management.

Learn moreESG

Real ESG ambitions is part of the core strategy.

Learn moreTurn Around and Recovery

Fast navigation through crisis

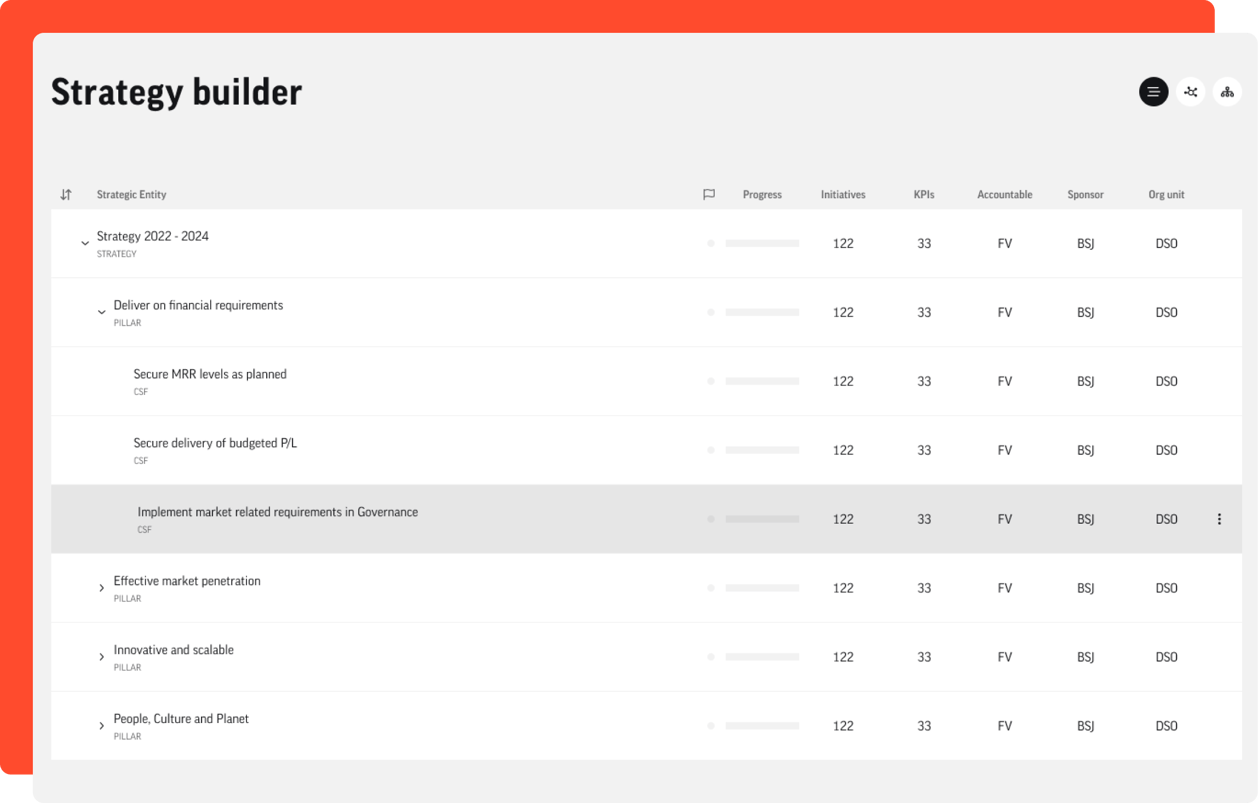

Learn moreCollaborating on Company Strategy, Execution, and Monitoring

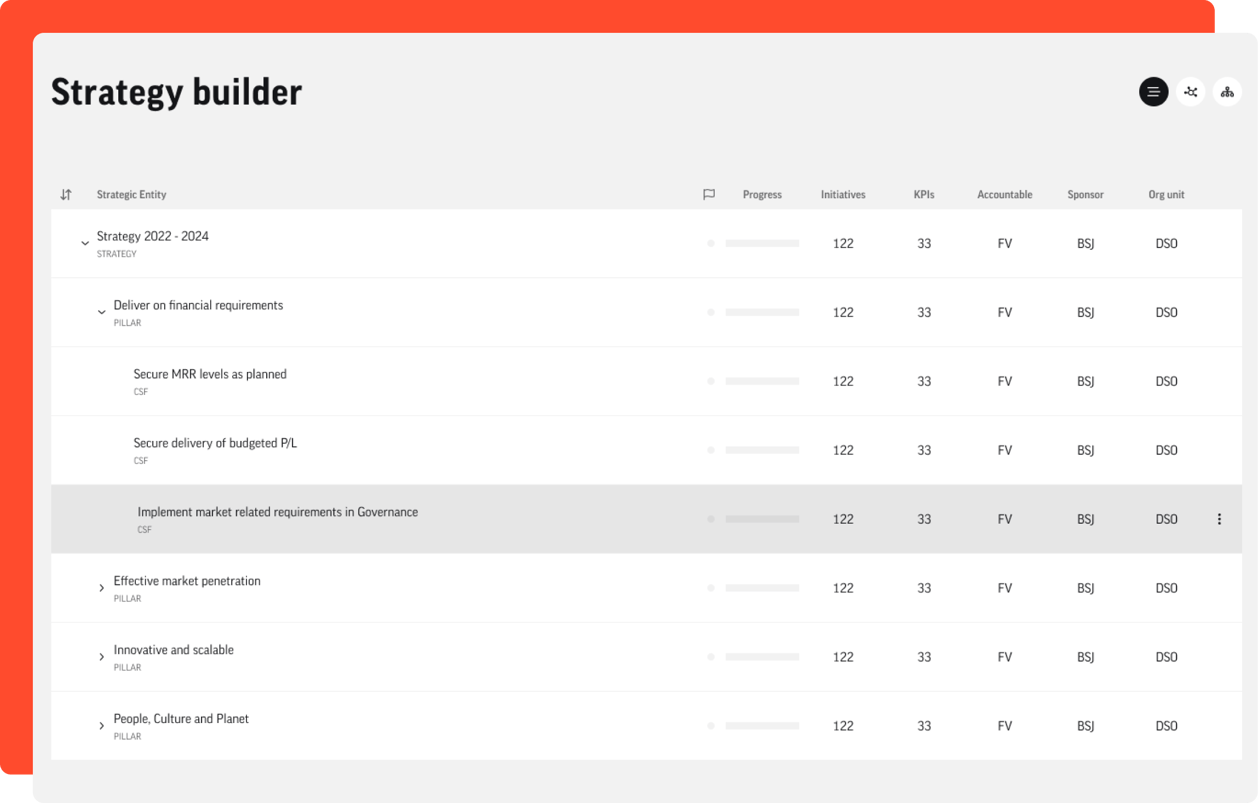

Both funds and portfolio companies would like help to source potential partnership opportunities in strategy. DecideAct is a digital infrastructure for strategy that can be personalized to support the needs of each fund and portfolio company. The platform helps assessing your organization's strategy execution style (“maturity level”). You get a comprehensive list of improvement points in relation to the current and desired state.

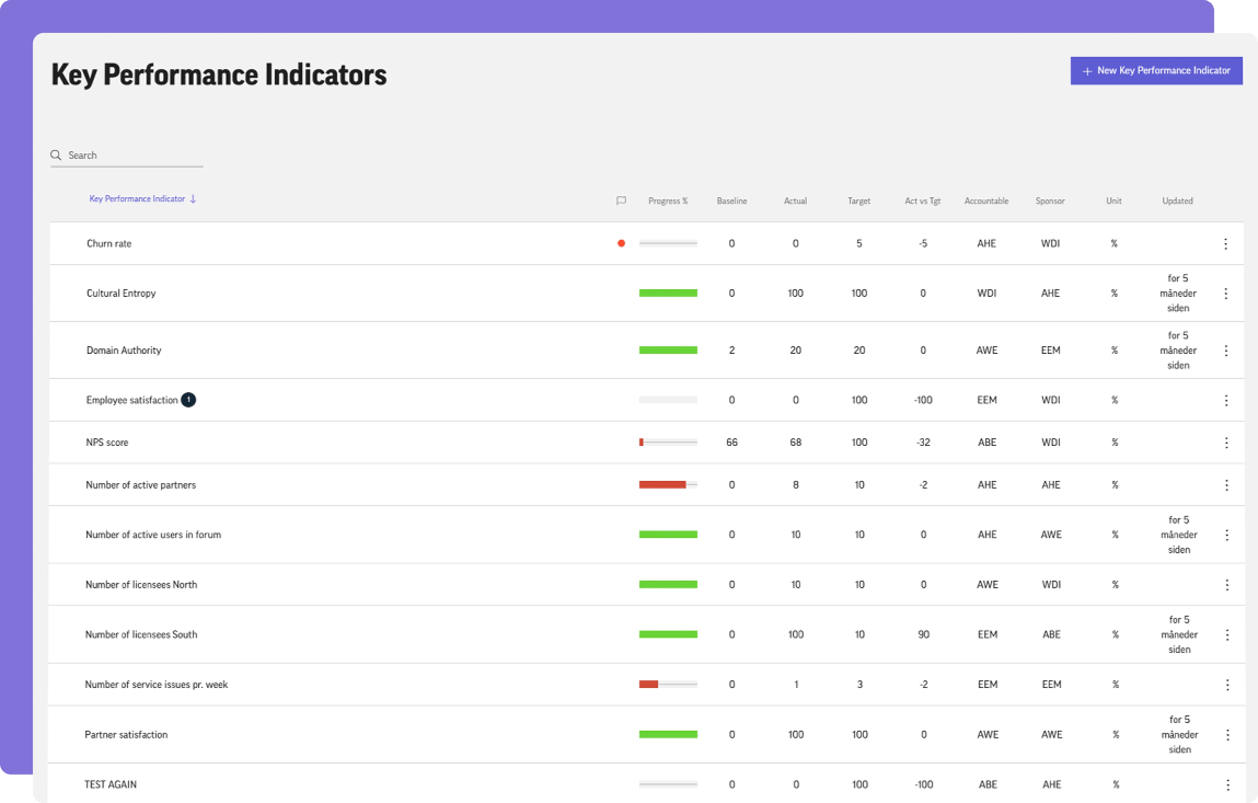

We want a short and precise optimization plan so we get most out of the money and secure that the plan is implemented effectively.

Both investors and portfolio companies seek for advancement of cost-cutting strategies for the business and mutual synergies. DecideAct addresses this through the ability to manage the Cost Optimization strategy within the strategy execution tool. In other words, a full collective and digital memory. We deliver a concise optimization structure securing you the most important insights on the impact and an assessment of your organization’s adaption and help delivering the desired values

Aligning on best possible governance around overview and participation in day-to-day management.

The differing desires for investor involvement in daily operations and the leadership's preferences often lead to conflicts. DecideAct enables mutual trust by aligning investors and management, facilitating learning, change, and innovation in daily management. The platform identifies priorities, crafts a clear roadmap for long-term goals and shareholder value, enabling confident management decisions while keeping investors informed from the sidelines."

ESG: Make the ESG Ambitions happen.

Our cloud-based Strategy Execution Management platform can turn any plan into action. Our new ESG platform works in concert with the Strategy Execution Management system for your overall organization.With international cooperative efforts such as the Paris Agreement, the Sendai Framework for Disaster Risk Reduction, and the UN 2030 Agenda for Sustainable Development, there is increased focus on climate change and how it threatens sustainable development.

Collaborating on Company Strategy, Execution, and Monitoring

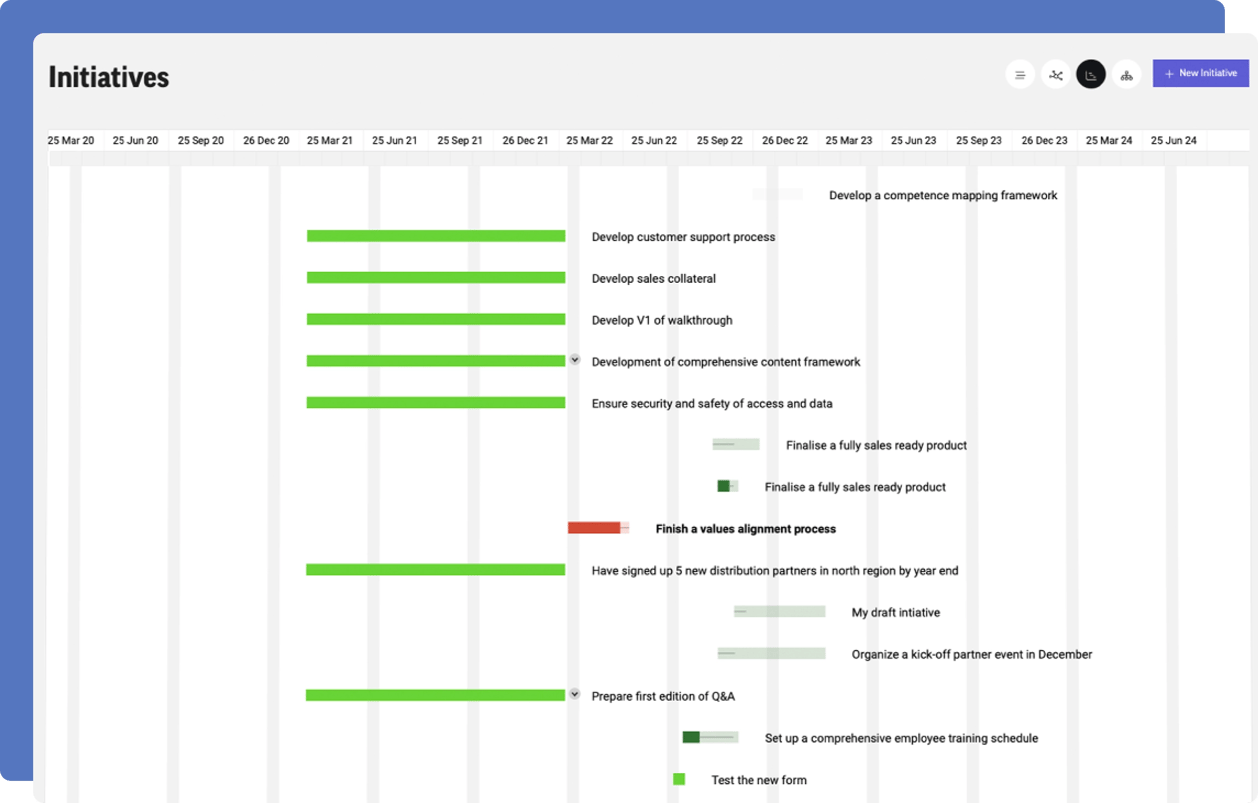

DecideAct helps navigating through crisis is about fast and secure execution of decisions. Those who sharpen their ability to execute and adjust strategies in an instant and agile way will have far better chances of survival and success. When it comes to executing a turn around or recovery strategy, you must make decisions and act on them in a timely manner or your business will get stuck in the swamp. Raise your ability to go fast and successful with Decideact platform.

Value Creation

Assistance in developing company strategy.

Learn moreCollaborating on Company Strategy, Execution, and Monitoring

Both funds and portfolio companies would like help to source potential partnership opportunities in strategy. DecideAct is a digital infrastructure for strategy that can be personalized to support the needs of each fund and portfolio company. The platform helps assessing your organization's strategy execution style (“maturity level”). You get a comprehensive list of improvement points in relation to the current and desired state.

Cost Optimization

Get most out of the money through cost optimizations strategies.

Learn moreWe want a short and precise optimization plan so we get most out of the money and secure that the plan is implemented effectively.

Both investors and portfolio companies seek for advancement of cost-cutting strategies for the business and mutual synergies. DecideAct addresses this through the ability to manage the Cost Optimization strategy within the strategy execution tool. In other words, a full collective and digital memory. We deliver a concise optimization structure securing you the most important insights on the impact and an assessment of your organization’s adaption and help delivering the desired values

Alignment

Aligning governance overview and participation in day-to-day management.

Learn moreAligning on best possible governance around overview and participation in day-to-day management.

The differing desires for investor involvement in daily operations and the leadership's preferences often lead to conflicts. DecideAct enables mutual trust by aligning investors and management, facilitating learning, change, and innovation in daily management. The platform identifies priorities, crafts a clear roadmap for long-term goals and shareholder value, enabling confident management decisions while keeping investors informed from the sidelines."

ESG

Real ESG ambitions is part of the core strategy.

Learn moreESG: Make the ESG Ambitions happen.

Our cloud-based Strategy Execution Management platform can turn any plan into action. Our new ESG platform works in concert with the Strategy Execution Management system for your overall organization.With international cooperative efforts such as the Paris Agreement, the Sendai Framework for Disaster Risk Reduction, and the UN 2030 Agenda for Sustainable Development, there is increased focus on climate change and how it threatens sustainable development.

Turn Around and Recovery

Fast navigation through crisis

Learn moreCollaborating on Company Strategy, Execution, and Monitoring

DecideAct helps navigating through crisis is about fast and secure execution of decisions. Those who sharpen their ability to execute and adjust strategies in an instant and agile way will have far better chances of survival and success. When it comes to executing a turn around or recovery strategy, you must make decisions and act on them in a timely manner or your business will get stuck in the swamp. Raise your ability to go fast and successful with Decideact platform.

Why now?

“Everyone has a plan until they get hit in the mouth!” - Mike Tyson

Why DecideAct?

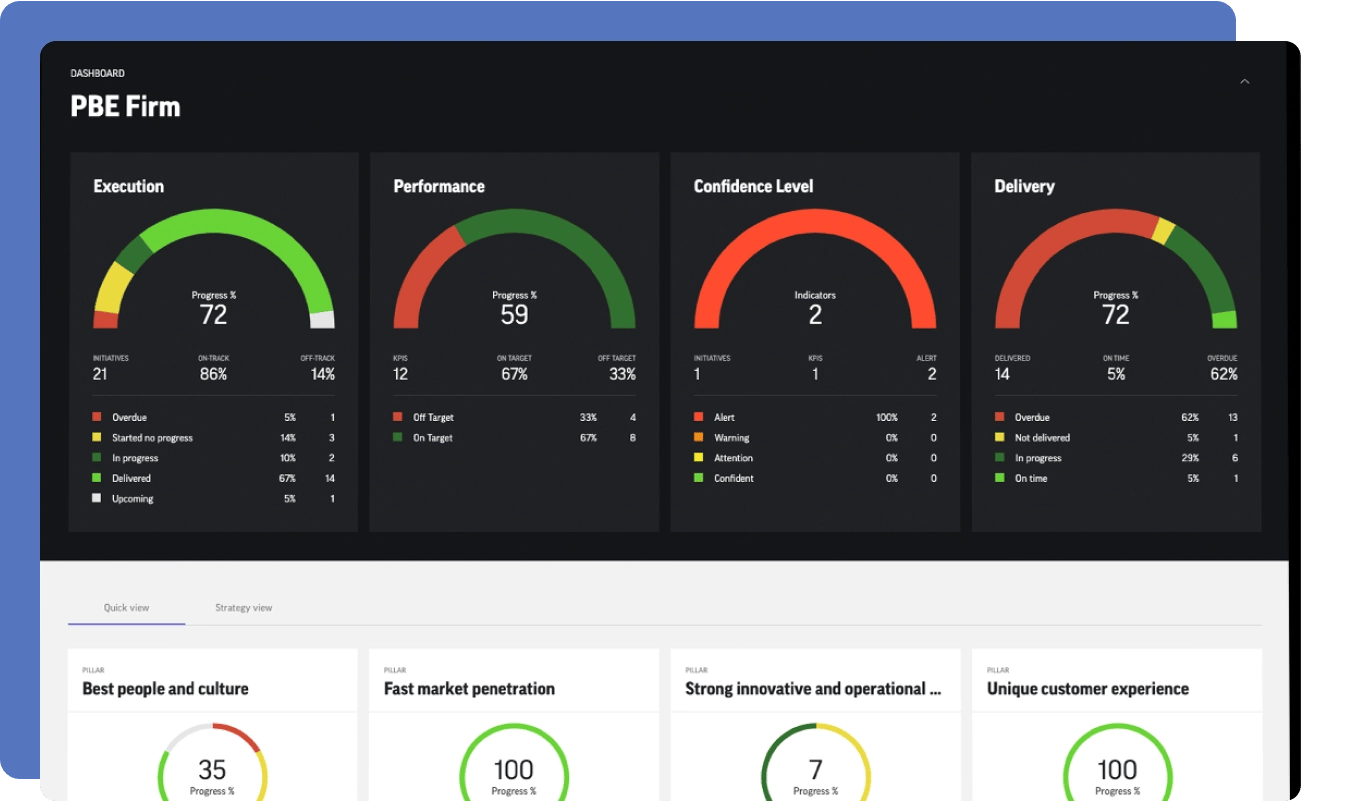

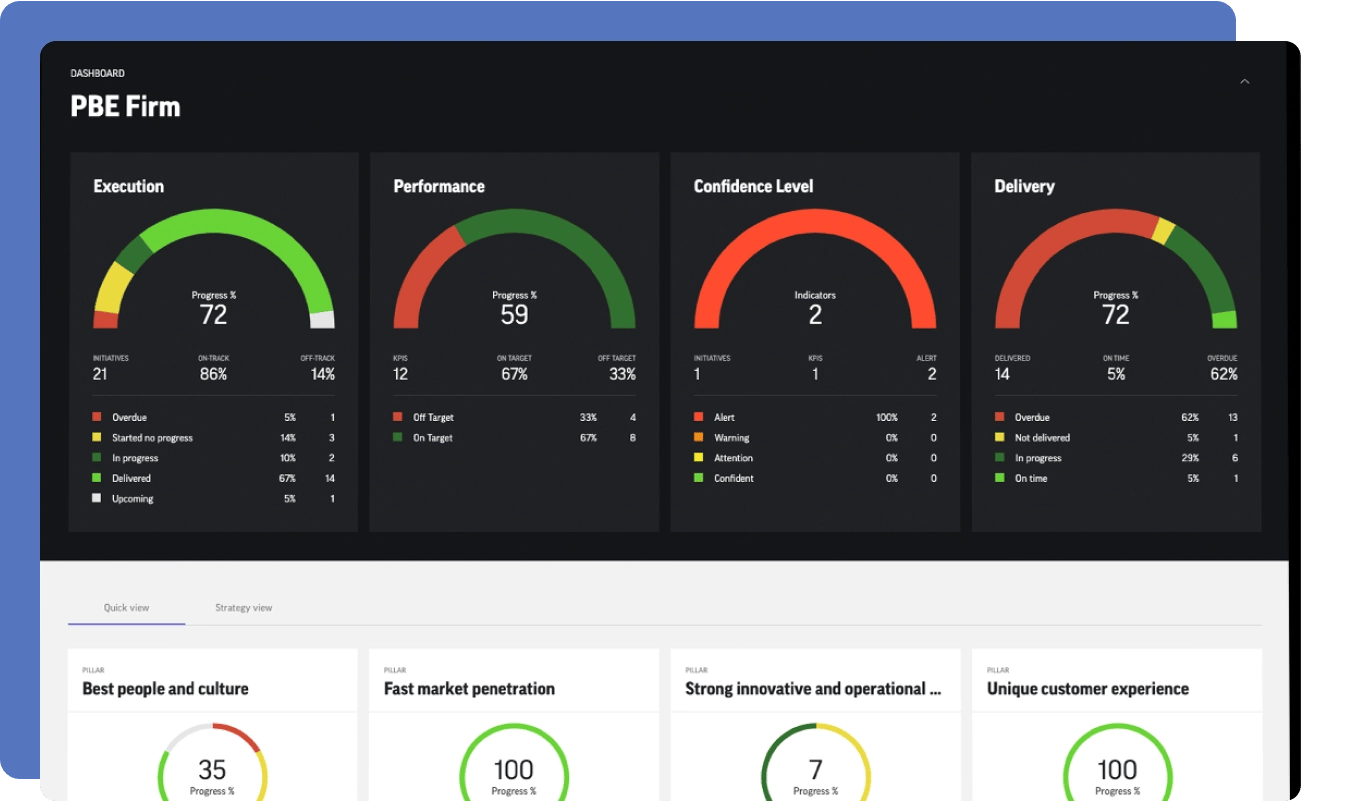

DecideAct’s solution supports exactly what you need to succeed together!

1

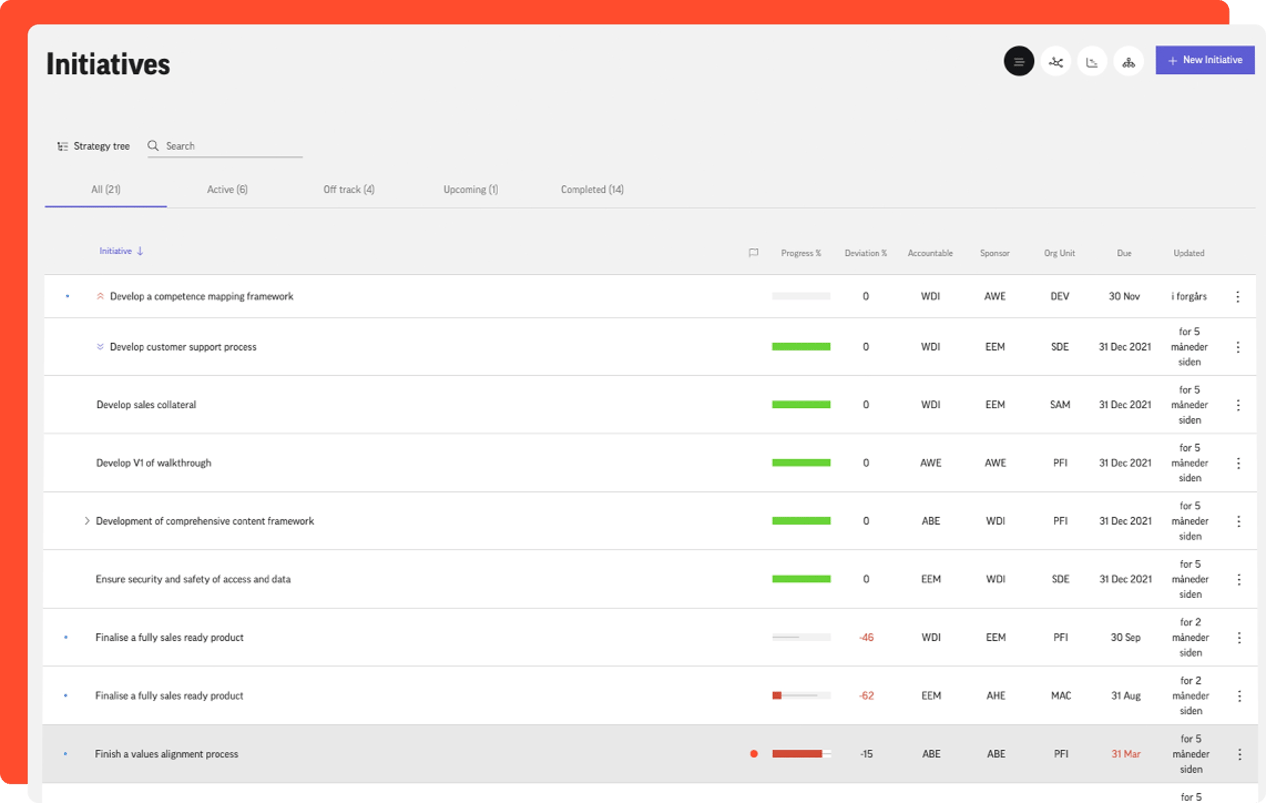

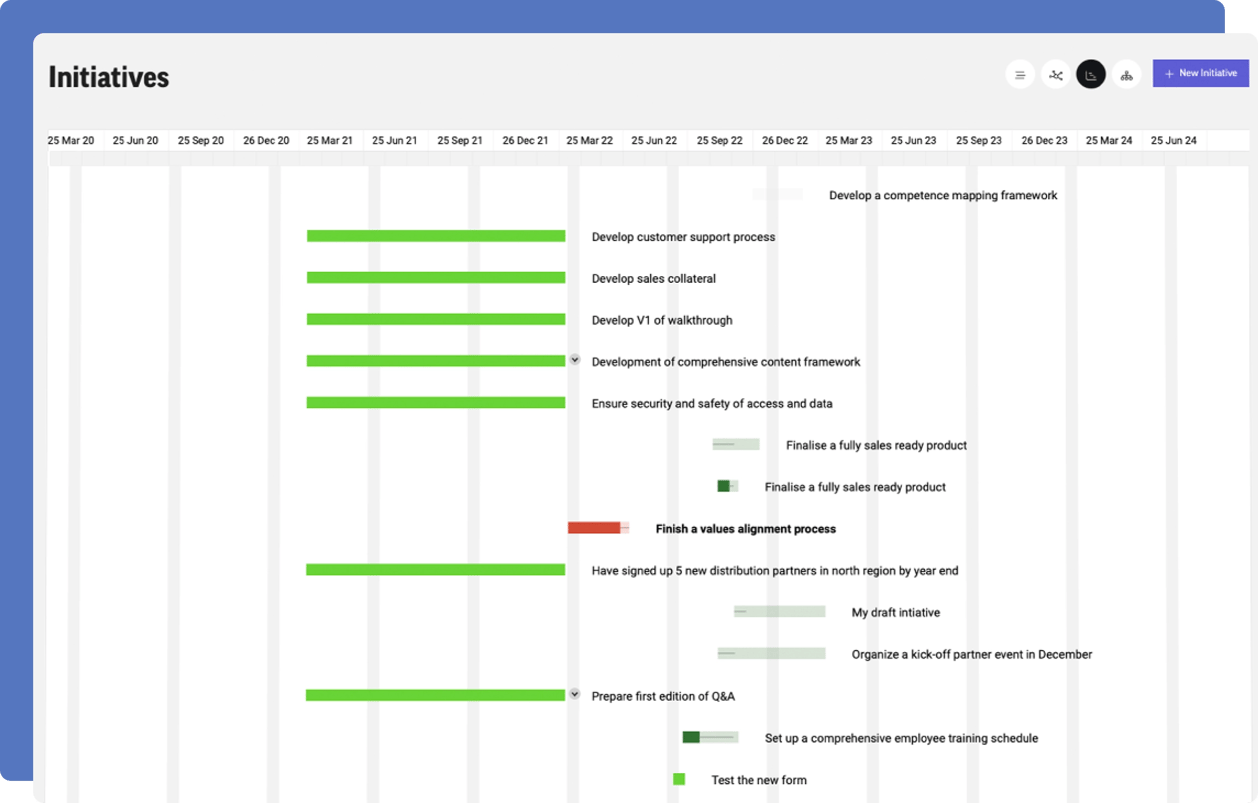

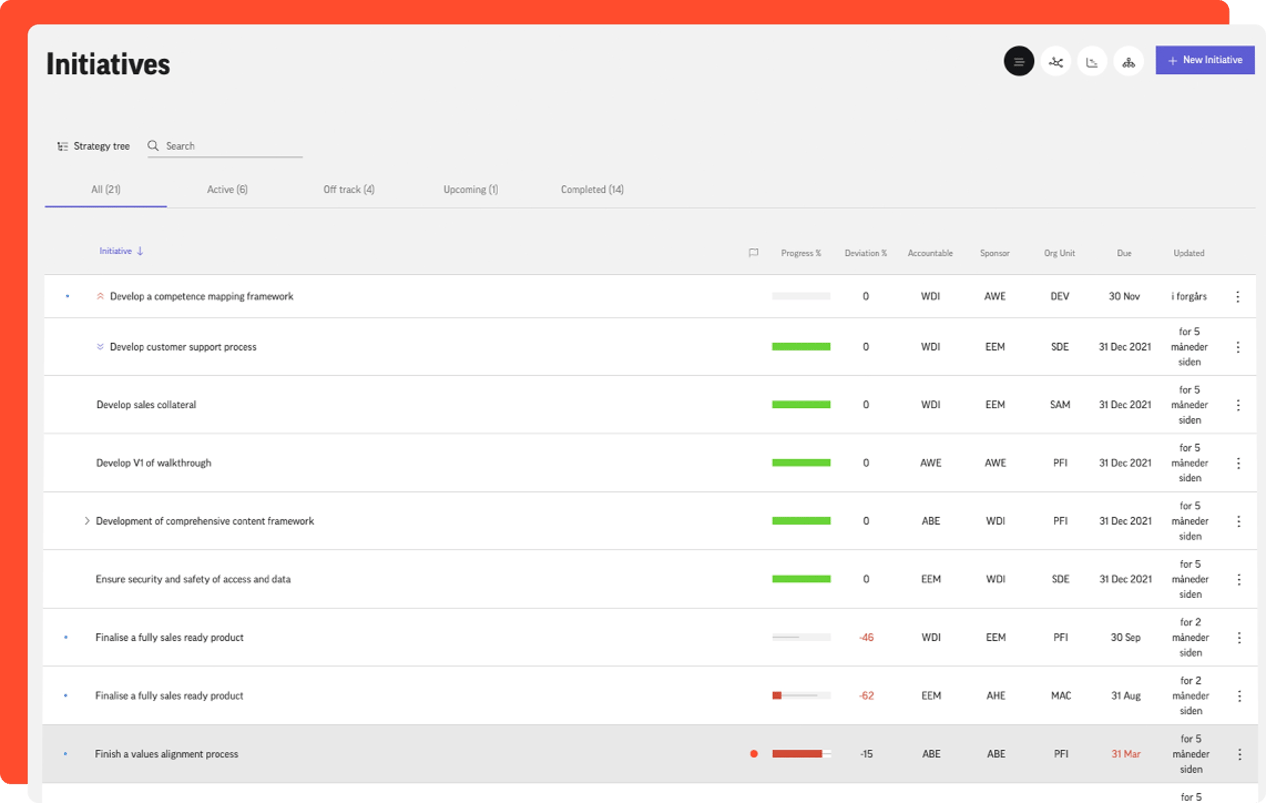

Enable internal operating partners to quickly view the consolidated status of all initiatives across portfolio companies.

2

Provide access to comprehensive lists of action items and due dates while allowing for easy updates.

3

Motivate collaboration between internal and external stakeholders, including CEOs of Investors portfolio companies.

There is no time to waste

Out with the old, in with the new

Ensures the best possible strategic and stakeholder governance around the overall strategy.

With the possibility of:

- Quick decision-making

- Early warnings Consistent follow-up

- Effective execution

- Flexible adaptation along the way

- The platform makes it possible to follow every action from government level over various public authorities and other actors to the individual citizen.